Your £2,000 personal loan does not need to hang around forever. Small changes in how you pay can lead to big savings. The journey to freedom from debt starts with simple steps that work.

The pound you pay above your normal amount helps cut your costs. Your loan gets smaller faster when you find ways to pay more. The bank takes less money from you over time this way.

Think about what happens when you pay just £20 more each month. Your loan ends sooner and costs less in the long run. Your money works harder for you instead of the bank.

4 Steps To Pay Off Personal Loans Faster

1. Make Biweekly Payments

Making payments every two weeks can change how fast you pay off your loan. This simple switch in timing helps pay less money over time. Your bank balance feels the same each month, too.

Let's look at a 5000 loan over 5 years. The normal way needs twelve payments each year. Breaking each payment into two smaller ones creates twenty-six payments yearly. The math shows this equals thirteen full payments.

For example, a £200 monthly payment splits into two £100 payments every other week. Your budget stays steady because you pay the same total each month. The extra payment happens slowly through the year.

Helpful Money Tips:

- Pay £100 every two weeks instead of waiting to pay £200 once per month

- Your loan balance drops faster with twenty-six yearly payments

- The bank charges less interest because the loan amount keeps going down

This payment plan works well with your payday schedule. Your money goes toward the loan more often. The loan balance shrinks faster than with monthly payments.

2. Round Up Your Payments

Rounding up your loan payments helps you win the money game. You hardly feel the pinch in your wallet. The extra cash chips away at your loan bit by bit.

Think about rounding up your £275 payment to £300. The extra £25 feels small in your budget each month. Your loan balance goes down faster without much effort from you. The bank gets less money from you over time.

The magic happens when these small amounts build up through the year. Your loan could end months early with this simple trick. Your future self will thank you for this easy money move.

Money-Smart Tips:

- Round your £180 payment up to £200 for an easy way to pay more

- Pick a number that works for your budget and stick to it each month

- Your loan shrinks faster when you add just a little extra cash

This plan puts you in charge of your money without much fuss. Your budget stays safe while your loan gets smaller. The path to freedom from debt becomes shorter with each rounded-up payment.

3. Use Windfalls to Pay Down Debt

The extra cash that comes your way can shrink your loan faster. Your tax money back works hard when you put it toward the loan. Work bonus money helps you break free from debt sooner.

Every pound from side work or surprise money makes your loan smaller. The bank takes less money from you when the loan amount drops. Your path to freedom from the loan gets shorter with each extra payment.

Think about what happens when you get £500 back from taxes. That money could cut weeks or months off your loan time. Your loan costs less in the long run when you use extra cash this way.

Quick Tips That Work:

- Put birthday money or work rewards straight into your loan payment

- Watch your loan shrink fast when you add bigger chunks of cash

- Keep your eyes on the prize instead of buying things you want right now

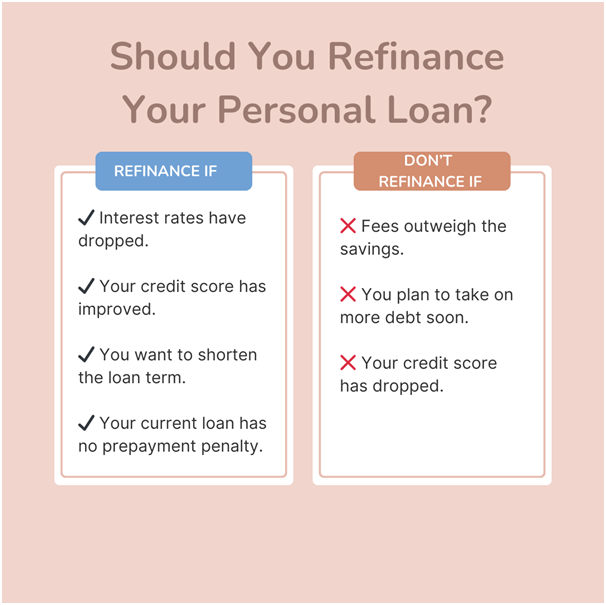

4. Refinance to a Lower Interest Rate

Your current rate might be higher than what banks offer now. A new loan with better terms puts more cash in your pocket.

The math works in your favour when you find a lower rate. Your monthly bills might stay close to the same amount. The big win comes from paying less money to the bank over time.

Moving to a shorter loan term helps, too, if your budget allows it. Higher payments each month mean less time stuck with the loan. Your total cost drops because you pay interest for fewer years.

|

Personal Loan Refinancing Options | ||||

|

Current Interest Rate |

Refinanced Rate |

Old Monthly Payment |

New Monthly Payment |

Total Interest Saved |

|

10% |

7% |

£250 |

£220 |

£1,200 |

|

8% |

5.50% |

£300 |

£270 |

£1,550 |

|

12% |

6.50% |

£400 |

£340 |

£2,400 |

Money-Wise Tips:

- Look at new loan rates every six months to catch better deals

- Ask banks about their fees before you switch your loan

- Choose a shorter loan time if your budget can handle bigger payments

You can check all costs before you jump to a new loan deal. Some banks want big fees to give you a new loan. The switch needs to save you more money than you pay in fees.

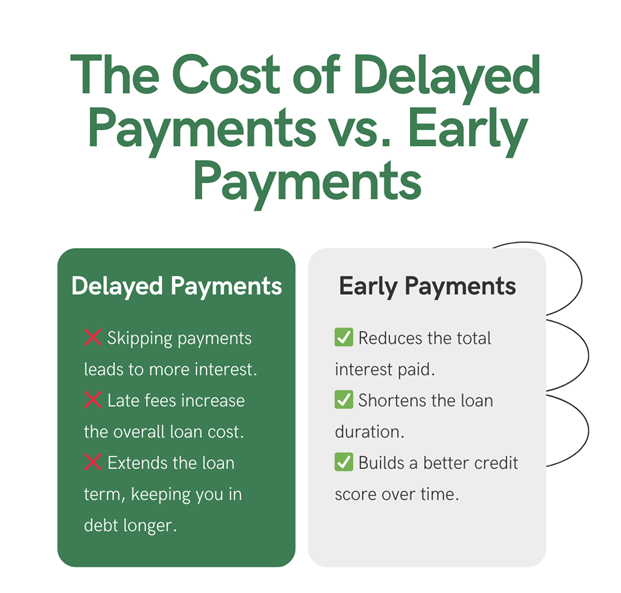

How Much Can You Save by Paying Off Your Loan Early?

Your £10,000 loan at 12% interest costs more than you think. Five years of payments add up to £13,346 when you pay the normal way. Early payments change this story.

Let's look at what happens with £50 extra each month. Your £222 payment grows to £272 each time. These cuts eight months off your loan time. You save £876 in interest over the loan.

Going bigger helps more - £100 extra monthly brings huge changes. Your loan ends fifteen months early. The total interest drops by £1,524. Your bank gets less while you keep more.

Quick Facts That Help:

- A £5,000 loan at 10% costs £1,374 in interest over four years

- Adding £75 monthly saves £482 and ends the loan nine months early

- Every £100 extra payment cuts about £45 from your total interest

You can use a loan helper on the web to see your own numbers. Your savings grow when you pay more than you need to. The money stays in your pocket instead of going to the bank.

What Are the Risks of Paying Off a Loan Early?

Some banks charge fees when you pay loans off too fast. The fee might eat up the money you save on interest. Your loan papers tell you if this might happen to you. Your money needs to work for your life first. Bigger loan payments should not hurt your daily needs. Keep some cash saved for times when things go wrong.

An early payoff might change your credit health a bit. Banks like to see different types of loans in your name. Your credit score could drop a few points when a loan ends.

Watch Out For These Things:

- A £5,000 loan might charge £250 if you pay it off two years early

- Keep at least £1,000 saved before making extra loan payments

- Your credit mix matters - think twice if this is your only loan

You look at your loan papers before making big moves and ask your bank about any fees that might pop up. Make sure faster payments fit your money plan.

Conclusion

The road to paying off your loan early starts with one step. Your future looks brighter when you take charge of your debt today.

Your plans make debt freedom happen faster. Your money stays in your pocket when you pay loans off early. The feeling of sending in that last payment makes all the work worth it.

Years from now, you will thank yourself for starting this journey. Your wallet grows stronger as your loan gets smaller. The path to freedom from debt becomes shorter with each smart choice you make.