There are many loan options you can use for personal and non-personal situations. A £1,000 personal loan from a direct lender often means faster approval with less paperwork.

Direct lenders offer clearer terms and faster decisions when you need financing quickly. Most of them allow people to deposit funds on the same day they apply, so that you can solve problems immediately.

Most banks and online lenders will provide this amount with little hassle. There is no need to make the lender understand the use of each penny.

The choice is yours. This is why a £1,000 loan is ideal for unexpected expenses when your savings are not sufficient to meet the requirement. Many individuals repay this amount between 12 and 24 months. This makes the monthly payments affordable.

Top Uses for a £1,000 Personal Loan

A £1,000 personal loan might be just what you need. This small but mighty sum can solve many money troubles without putting too much strain on your budget.

Car Repairs

Car trouble always seems to happen at the worst time. Your MOT fails, and now you need new brakes. A £1,000 loan can get you back on the road quickly without waiting for payday. Most garages want payment right away. This loan covers most basic fixes that keep your car safe and legal.

Home Fixes

The boiler picks the coldest day to break down. Someone's football just smashed your window. Home fixes often get worse and cost more if you delay. With £1,000, you can stop that leak, fix that boiler, or replace that broken glass before more damage happens.

Medical Costs

The NHS is great, but some things still cost money. Medical costs can feel scary. A small loan means you don't put off health needs. Your well-being comes first, and payment plans make it easy to handle costs over time.

Debt Merge

Merge them into one simple payment. This move can lower your stress and save on interest. You'll have just one date to remember each month. Your credit score might thank you for this smart money move.

Moving Costs

Moving costs add up fast. A £1,000 loan helps bridge the gap between old and new homes. You can settle in without eating beans for a month. This small boost means your move stays smooth instead of stressful.

Wedding Expenses

The modest weddings have costs such as the dress, rings, venue hire, or just enough food for close family. A small loan can make your big day happen without huge debt. You can focus on your vows instead of your bank balance. You'll likely pay it off before your first wedding day.

Emergency Travel

Emergency travel costs a lot with no warning or time to save. A quick £1,000 loan means you're there when it matters most. Some things can't wait for your next pay packet.

Education Fees

Learning costs money up front but pays back for years. A small loan for education is money spent on yourself and your future. Better skills often lead to better pay.

Pet Bills

Pets are family, but they don't have health cards. A £1,000 loan can save your furry friend's life when you're short on cash.

Appliance Swap

The fridge died, and the food is spoiling. The washing machine floods your kitchen. The cooker won't heat up. Major home gadgets break at the worst times. A small loan lets you replace them fast without waiting months to save up.

Who Should Apply for a £1,000 Loan?

You're ideal for this loan if you earn steady money each month. Your credit doesn't need to be perfect. Can you spare a small sum each month for a year or two? This could work well for you.

A £1,000 personal loan from a direct lender cuts out the middle steps and often means faster approval. The direct lenders look at your whole story, not just numbers. They offer clear terms with no hidden fees and quick decisions.

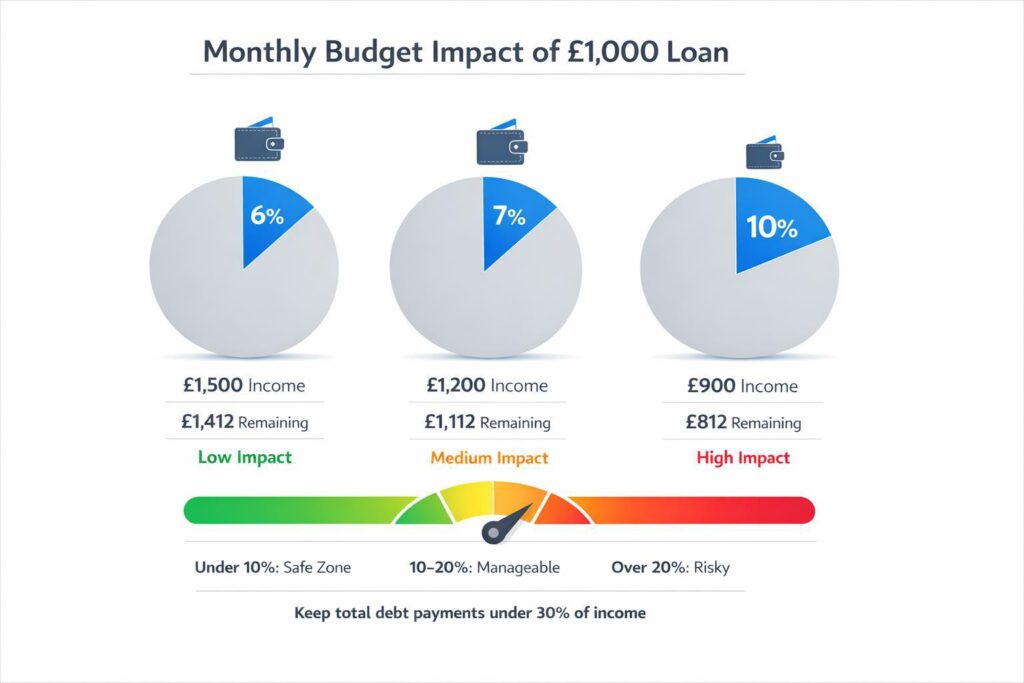

This loan is for people who need cash now but can handle the repayment plan. It's best when you have room in your budget for a new small payment. The right amount at the right time can solve problems before they grow bigger.

| Eligibility Factors for £1,000 Loan | ||

| Factor | What Lenders Want | Impact Level |

| Age | 18+ (21+ for some) | High |

| Income | Steady, provable | High |

| Credit Score | Fair to Good (600+) | High |

| Employment | Full-time, part-time, self-employed | Medium |

| Debt Level | Low existing debt | Medium |

| UK Residency | Must live in the UK | High |

| Bank Account | Active account in the UK | High |

Are There Limits on How You Spend It?

Most lenders deposit the cash directly into your bank account and trust you to use it wisely. You won't need to show proof of purchase or explain every pound spent. The money becomes yours to use as needed once approved.

- Freedom to tackle your most urgent needs first

- Shift funds between needs as your situation changes

- No awkward calls asking why you spent on one thing, not another

- Loan terms stay the same, no matter how you use the funds

You can check your loan terms first, while most uses are fine. Some lenders don't allow gambling or illegal purchases. You choose how best use the money for your needs beyond these few limits. The main focus is that you can repay on time, not what you buy.

What If You Don't Use the Full £1,000?

Taking the whole sum means paying interest on the entire amount, even on parts you don't spend. Some smart moves include paying back early if your lender allows it. You can look for loans without early payment fees to keep this option open.

- Think of unused funds as a head start on next month's payment

- Track where every pound goes to avoid waste

- Create a mini emergency fund with any leftover amount

- Consider a smaller loan amount if your needs change before signing

- Find joy in paying less interest by returning unused portions early

You only borrow what you need. If £800 would do the job, ask for that instead. The best loan is one that solves your problem without creating new ones.

A small personal loan can be the perfect fix for life's sudden costs. You turn a short-term loan into a smart money move with clear plans for both using and repaying the money.

Conclusion

Borrowing £1000 is a wise decision when you need something now and will settle it later. It is all about matching the loan to the actual needs, not the wants. Borrowing only what you need, setting reasonable terms, and adhering to the payment schedule are possible.

You will be in a position to pay on time to develop your score for future borrowing. You can think carefully and have a vision of paying it off.